2024 | Credit Card Management App - UI/UX Design Challenge

Introduction

In a fast-paced digital economy, financial management applications must be intuitive, efficient, and visually engaging. As part of a UI/UX design challenge, I took on the task of designing a Credit Card Management Application. The challenge was to create a user-friendly mobile interface that simplifies credit tracking, payments, and financial insights—all within an hour and a half.

Design Approach

Understanding that finance can sometimes be overwhelming, I focused on crafting a visually appealing yet highly functional interface that would make managing credit cards effortless for users. Below are the key considerations that shaped my design decisions:

1. Color Palette & Aesthetic

- Primary colors: #114040, #2F9D9D

- Inspired by money (green symbolizes financial growth and stability)

- Gradient elements to mimic the glossy, metallic feel of credit cards

2. Typography

- Font Used: Poppins

- Chosen for its modern, clean, and highly legible characteristics, ensuring a seamless reading experience.

3. Information Architecture

To create a structured and logical flow, I built an Information Architecture using FigJam, which helped me visualize the various elements and screens, such as:

- Settings Page (Security settings, Notifications, Preferences)

- Credit History Page (Detailed transaction breakdowns, Categorized expenses)

- Profile Settings (User details, Payment preferences)

- Dashboard & Insights (Credit overview, AI-powered financial advice)

Mapping out the hierarchy and relationships between these components in FigJam provided a clearer picture of how users would navigate the app efficiently.

Designed Screens

To provide a holistic user experience, I designed seven screens, ensuring that every crucial aspect of credit management was covered.

1. Sign-In & Sign-Up Screens

- Simple, clutter-free UI for effortless onboarding.

- Minimal fields to reduce cognitive load.

- A welcoming tone to enhance user engagement.

2. Dashboard (Credit Overview)

- Card-based design for quick insights.

- Progress bar indicating available vs. utilized credit.

- Call-to-Action (CTA) for users to make payments.

- Pending transactions indicator to inform users about unsettled dues.

3. Transaction History

- Chronological display of recent transactions.

- Clear categorization of expenses.

- Search and filter options for easy navigation.

4. Settings Page

- Essential security and preference options.

- Profile & biometric settings for added security.

5. Credit Score Tracking

- Score gauge with color indicators (Red - Poor, Yellow - Average, Green - Excellent).

- Trend graph showcasing monthly credit score fluctuations.

- Utilization vs. Score scatter plot to help users understand their credit behavior.

6. AI-Powered Insights

- AI Floating Action Button (AI FAB) that provides:

- Personalized credit advice

- Credit utilization tips

- Score improvement suggestions

- Explanations for credit score factors

Key UX Enhancements

1. Card-Based Design for Readability

- The entire UI adopts a card-based structure, ensuring information is easy to digest.

2. Financial Transparency with Visual Aids

- Graphs & progress bars eliminate the need for users to manually interpret numbers.

3. Action-Oriented UI

- Users are guided toward essential actions (e.g., Pay Now, View Transactions) with well-placed CTAs.

Time Challenge & Execution

- Completed in approximately 2-3 hours.

- Prioritized usability and clarity while maintaining an aesthetic appeal.

- Ensured a balance between speed and design precision.

- Given more time, I would conduct usability testing to refine micro-interactions and optimize the user journey further.

Learning Takeaways

While working on this project, I gained deeper insights into how credit card management systems operate, including:

- The importance of credit utilization ratios and their impact on credit scores.

- How pending transactions affect available credit.

- The significance of progressive disclosure in financial apps to reduce information overload.

- The role of AI-driven insights in helping users manage their financial health better.

Final Thoughts

I thoroughly enjoyed working on this challenge! It was an exciting opportunity to push my design thinking under a tight deadline while ensuring usability and functionality. This project reinforced the importance of user-friendly financial designs and how even complex information can be presented in a clear and engaging manner.

Tools used

Topics

Share

Reviews

1 review

Hello Nikita,

Your project is very well-executed, and it was genuinely engaging to follow your thought process throughout the design. The structure of the presentation is clear and comprehensive, and it would be even more impactful if you added user personas to provide additional context and highlight the specific needs that guided your decisions.

The color palette is excellent—well-chosen and visually appealing, perfectly complementing the overall design. One suggestion might be to consider slightly increasing the size of the bottom menu for improved usability, especially for mobile users. However, this is just a minor adjustment, as the current design is already highly functional and user-friendly.

Well done!

You might also like

Accessible Signup Form

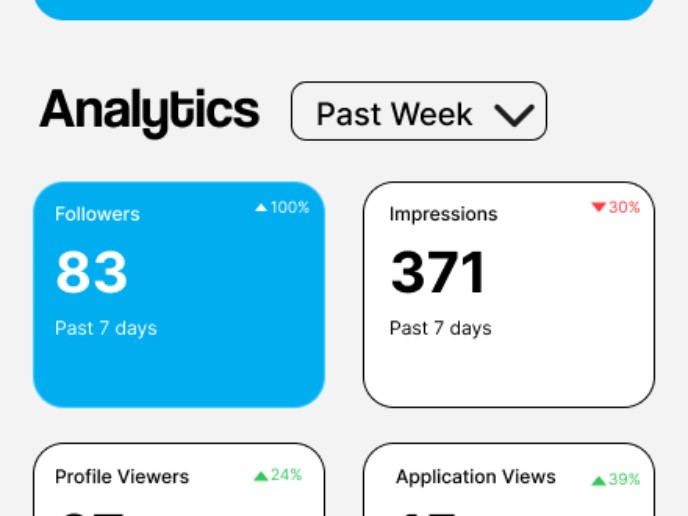

Entrant - Analytical Dashboard

Transit Cairo — Digital Mobility Redefined

Babylon Balance - Designing Financial Clarity Through Constraint

Entrant Accessible Signup and Login Forms

CJM x Mindspace case study - Ester Cinelli

Popular Courses

Prioritization and Roadmapping

Design Thinking