Empathy Map - Hargreaves Lansdown

Design Task Overview

Product Name: Hargreaves Lansdown

Device Type: Desktop

Platform: Personal investments account

Target audience

- Self-directed investors

- Aged 30–55

- Financially literate

- Comfortable with digital banking

- Managing long-term financial products like pensions, ISAs, and investments

- Logs in 1-3 times per week

- Utilises trusted online financial advice

- Risk aware but cautious, lacking confidence in choosing funds themselves etc.

Research approach

- User Interviews with between 6 and 8 target audience usersto understand their experiences, preferences, and frustrations.

- Surveys to the general target audience population (expected over 200 responses) to bolster qualitative feedback with quantitative data on usage

- Analytic analysis of real user behaviour (how do users behave, journey funnels etc)

- Social listening on platforms such as reddit

- Observe 5 users as they use their desktop system to uncover usability issues, needs and frustrations.

Key Insights

Users Want Simplicity, Not Overload

- While they value access to financial tools, users feel overwhelmed by excessive data, jargon, and choices.

- They seek clear, actionable guidance — not a firehose of information.

Confidence Is a Barrier

- Many users lack confidence in their investment decisions, especially when choosing funds or interpreting risk levels.

- This leads to hesitation, inaction, or over-reliance on default options.

Communication Needs to Be Friendlier

- Users are frustrated by unclear fees, financial terminology, or overly formal tone.

- They respond better to plain English explanations, examples, and contextual help.

Emotions Play a Big Role

- Financial anxiety (e.g. fear of losing money or missing a tax deadline) is common.

- Users are looking for emotional reassurance as much as financial outcomes.

Conclusion

The empathy mapping exercise for Hargreaves Lansdown reveals that these target investors are motivated by long-term financial growth but often feel overwhelmed, underconfident, and unsupported. While they value the platform’s capabilities, they struggle with complex language, unclear fees, and a lack of proactive guidance. By simplifying communication, surfacing help more effectively, and offering emotionally supportive UX, Hargreaves Lansdown has the opportunity to transform uncertainty into trust — and inaction into confident investment behaviour.

Reviews

4 reviews

Really well done mate! great job!

Love this, very insightful and detailed

Would love to see how you would progress this within Hargreaves Lansdown's digital experience

... You could even create use this to create a "deck" of recommendations

Hello Jamie, excellent work on this Hargreaves Lansdown empathy map! Your research methodology is solid, and the insights about user confidence, communication preferences, and emotional needs are clearly identified. You've done an excellent job understanding the target investors and their pain points. Great work!

This research feels really thorough and well-rounded! By combining user interviews, surveys, and analytics, you've got a solid understanding of what your users need and want. It's clear that simplicity and clear guidance are key, users are overwhelmed by too much info and jargon. It's also interesting to see that confidence is a major barrier for users when it comes to investment decisions. The finding that users respond better to plain English and contextual help makes total sense. And I love that you're highlighting the importance of emotional reassurance - financial anxiety is real! Overall, this research provides some great insights for improving the user experience and building trust with your users.

You might also like

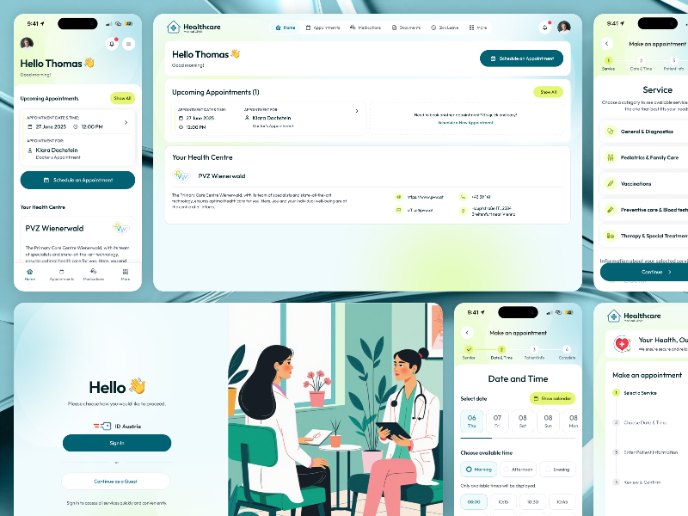

💊 Healthcare Desktop & Mobile App UX/UI Design

Fitness Challenges App

Personal Wellness Dashboard

Events Managment App

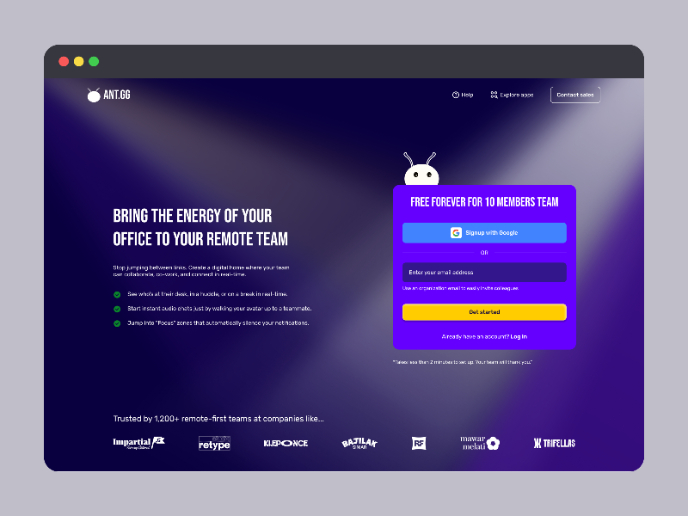

SaaS Signup Design

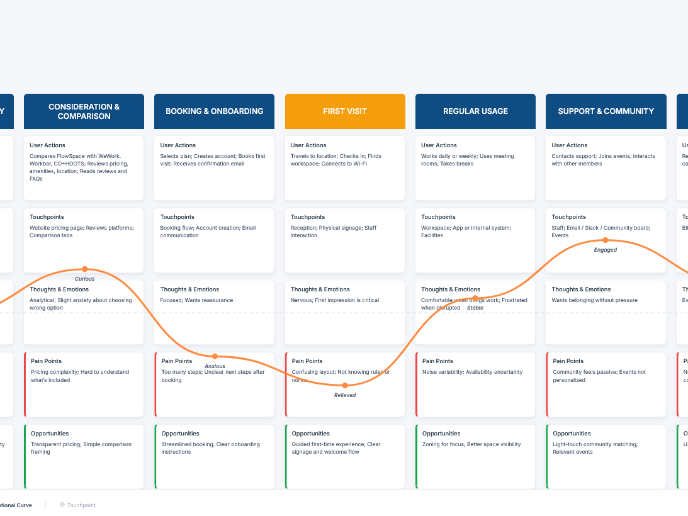

Customer Journey Map — Offsite Co-Working Experience

Design Leadership Courses

UX Design Foundations

Introduction to Figma