Mobile Banking App

The development of an empathy map and analysis of user pains and gains in this project follows a structured decision-making process aimed at delivering a user-centred design for a mobile banking app.

Why a mobile banking app?

A mobile banking app was selected as the platform due to the increasing reliance on mobile devices for financial management, particularly among younger demographics. According to research, millennials and Gen Z prefer mobile-first experiences and handle most of their day-to-day financial activities through smartphone apps. Focusing on a mobile app ensures that the design aligns with the behaviour of the target audience—young professionals, like our persona, Emma.

Understanding the Target Audience

Before diving into the design process, it was important to define a user persona based on common characteristics of the target audience. Emma, a young professional in her late twenties, represents a typical user who values convenience, security, and personalised financial insights. The decision to focus on a persona like Emma stems from market data that suggests young professionals are highly engaged with financial technology but often feel underserved in terms of personalised features and guidance.

Identifying Key Pain Points

The empathy map identifies five key pain points for the user, focusing on barriers to usability and emotional responses to the product. These pain points—complex navigation, security anxiety, lack of guidance, overwhelming information, and missed notifications—are typical issues that users encounter when engaging with mobile banking apps. Each of these pain points is directly tied to user experience research, which highlights the importance of usability, trust, and clarity in financial apps.

Understanding User Gains

In parallel with pain points, understanding what users value (gains) is critical for designing solutions that offer real benefits. For Emma, the desired gains revolve around simplicity, financial clarity, enhanced security, timely notifications, and a sense of progress. These gains represent positive experiences that make the user feel empowered and confident in their financial management.

Empathy Mapping

The empathy map serves as a foundational tool to capture what the user says, thinks, does, and feels when interacting with the product. This framework helps to humanise the user’s experience, allowing the design team to step into the user’s shoes and understand their emotional and practical interactions with the app. It also highlights gaps between what the user wants and what they currently experience, providing a clear path for design improvements.

Designing for Pain Reduction

Reducing pain points is essential for creating a seamless user experience. In this project, the focus is on simplifying navigation, enhancing security with ease, providing clearer financial guidance, and delivering timely notifications. Each pain point was matched with a corresponding design solution, grounded in user feedback and industry best practices.

- For example, simplifying navigation addresses users’ frustration with finding key features by introducing a cleaner layout and better search functionality.

- Biometric authentication resolves security anxiety by balancing ease of use with robust protection.

Designing for Gains

Designing features that promote gains means going beyond basic functionality to deliver an experience that actively supports the user’s goals. For Emma, this means designing features that provide clarity and a sense of control over her finances. For example:

- Personalised insights give Emma clarity into her spending patterns and help her make informed decisions.

- Customisable notifications ensure she receives timely, relevant updates about her account, reducing stress and preventing financial missteps.

- Goal tracking provides Emma with tangible markers of progress, reinforcing positive behaviours like saving.

Rationale for Insights

After mapping out pains and gains, key insights are drawn to inform the design process. These insights provide actionable recommendations for product improvements. For instance, the insight that users feel overwhelmed by too much financial jargon leads to a decision to prioritise clarity and simplicity in the user interface. Similarly, the insight that users want personalised guidance leads to the decision to integrate AI-driven insights into the app.

Conclusion

The decision-making process behind this project is focused on understanding and addressing the core needs of the user through a blend of empathy mapping, pain and gain analysis, and actionable insights. The goal is to create a mobile banking app that not only solves functional problems but also provides a personalised, emotionally satisfying experience. Each design decision is grounded in research, ensuring that the app meets user expectations while aligning with broader trends in the fintech industry.

Reviews

5 reviews

Great job! It's clear that a significant amount of time and thought went into the project. The research is clear and well-articulated, and I appreciate how you thoughtfully connected each pain point to its corresponding solution.

Suggestions:

Including screens or charts that run in parallel while comparing the old and new solutions might make it easier for viewers to grasp the changes and their impact quickly.

I’d like to hear your thoughts on this suggestion!

This is an engaging and visually warm cover for a Mobile Banking App project! You've used a great mix of photography and illustration to hint at the human and collaborative aspects of the design process.

Greate job!

Hi Ally,

Great presentation here. You covered a lot of great pain points, particularly the lack of use of investing or saving features within the app. I think it relates to a lack of feeling in control over our money (which you also covered).

As UX designers, it's always good to keep in mind that most people will feel a certain level of anxiety when managing their money through an app. Your empathy map did a great job of capturing the little but important details about this.

Fantastic work. I love how you first grounded the data into the persona first before going into the empathy map. The empathy map itself is quite detailed, giving us insights of what her full experience with the app is. For an area of improvement, I'd suggest you balance the images at the start with the persona and the empathy map. For instance, adding a few more icons on the empathy map would have enhanced the text itself. Overall, fantastic work on making us understand Emma's mobile banking journey.

You might also like

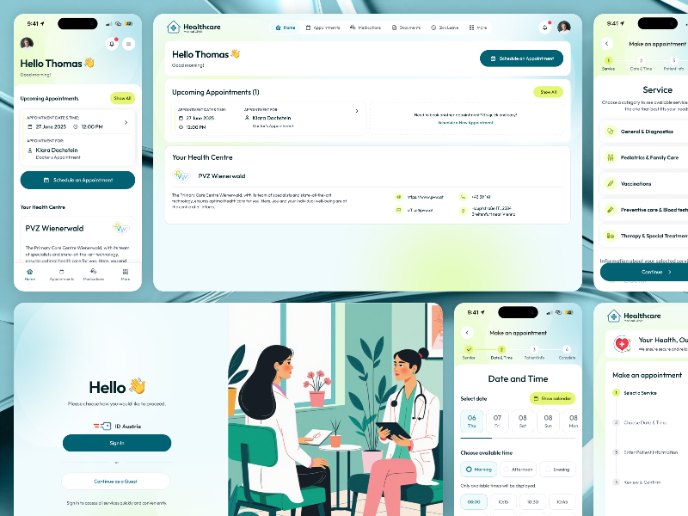

💊 Healthcare Desktop & Mobile App UX/UI Design

Fitness Challenges App

Personal Wellness Dashboard

Events Managment App

SaaS Signup Design

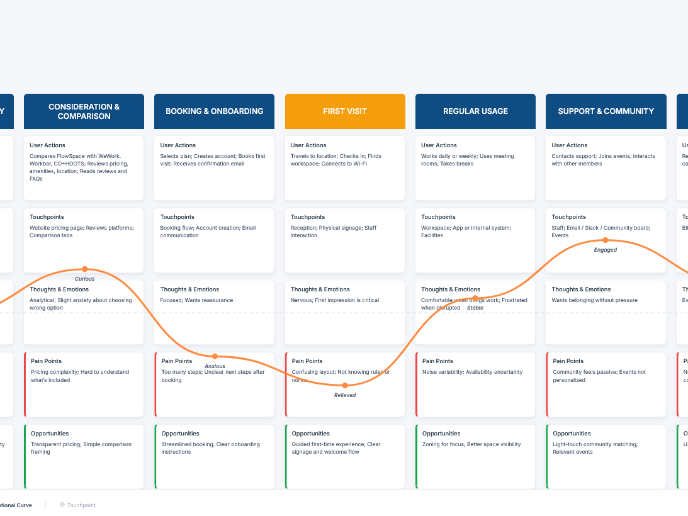

Customer Journey Map — Offsite Co-Working Experience

Design Leadership Courses

UX Design Foundations

Introduction to Figma