FinEase Mobile

Design Task Overview

Selected Financial Platform: Mobile Banking Application

Product Name: FinEase Mobile

Device Type: Smartphone

User Research

To gather insights for the empathy map, we will employ various user research methods such as user interviews, surveys, and contextual inquiries. The focus will be on understanding the experiences, pain points, needs, and behaviors of the target audience, which in this case are everyday users of mobile banking applications.

Target Audience

- Age Group: 18-60

- Profession: Students, professionals, retirees

- Tech Savviness: From novice to tech-savvy users

- Location: Urban and suburban areas

Research Methods

- User Interviews: Conduct in-depth interviews with 5 users to understand their experiences, preferences, and frustrations.

- Surveys: Distribute surveys to a broader audience (100+ respondents) to gather quantitative data on usage patterns and pain points.

- Contextual Inquiries: Observe 5 users as they interact with their mobile banking apps to identify usability issues and unarticulated needs.

Insights Gathered

- Security Concerns: Users are highly concerned about the security of their personal and financial information. They need reassurances about the app’s security measures.

- Measure of Success: Users report feeling secure using the app, with no significant security breaches reported.

- Ease of Use: Users prefer a simple and intuitive interface that allows them to quickly access their account information and perform transactions without hassle.

- Measure of Success: High user satisfaction ratings for the app's navigation and user interface.

- Reliability: The app’s performance is crucial. Users expect it to be fast, responsive, and available at all times without crashes or downtime.

- Measure of Success: Consistently high uptime and positive feedback regarding app performance.

- Integration: Users value features that integrate with other financial tools and services, providing a seamless financial management experience.

- Measure of Success: Increased user engagement due to seamless integration with other financial services.

- Proactive Communication: Users appreciate real-time notifications and alerts for account activities, helping them stay informed and in control of their finances.

- Measure of Success: Positive feedback on the effectiveness and timeliness of notifications and alerts.

- Support Accessibility: Easy access to customer support within the app is essential for resolving issues promptly and efficiently.

- Measure of Success: Reduced response times and higher resolution rates for customer support queries.

Conclusion

Using the empathy map, we can identify key areas to focus on while designing the mobile banking application. Addressing security concerns, enhancing usability, ensuring reliability, integrating useful features, providing proactive communication, and making support accessible are critical for meeting user needs and improving the overall user experience. These insights will guide the design process, ensuring that the app not only meets user expectations but also provides a competitive edge in the market.

Reviews

5 reviews

Great work on the empathy map. Your work is very thorough and detailed, with clearly defined pain points, motivations, and summarized insights. Well done!

A great presentation, very detailed. I love it, good teams always need you.

Hello Nick, this empathy map and research overview are thorough and well-structured. You've clearly identified your target audience and combined user interviews with surveys to gather both qualitative and quantitative insights. The insights section effectively translates research into actionable design considerations around security, usability, and integration. Great work!

Excellent breakdown Nick. I think you covered most of the concerns fintech users would go through when using such an app. Ultimately, when it comes to managing our money, we can all feel a little anxious. As designers we can alleviate a lot of that anxiety for people.

Once again, great job!

Well structured mapping! Loved it!

You might also like

Events Managment App

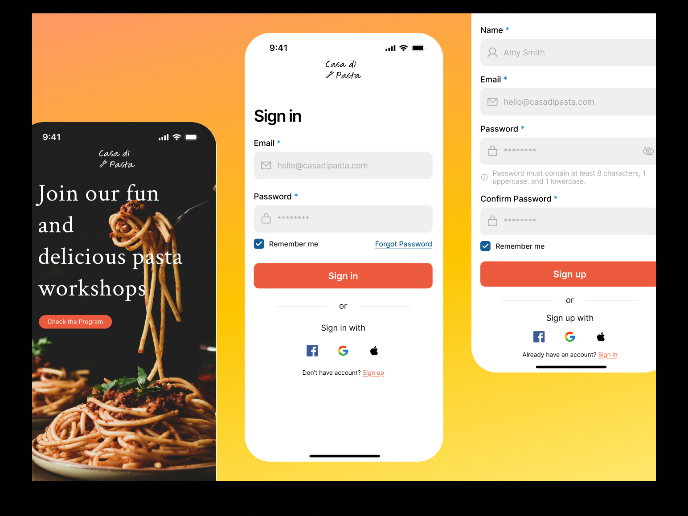

Mobile Onboarding: Casa di Pasta

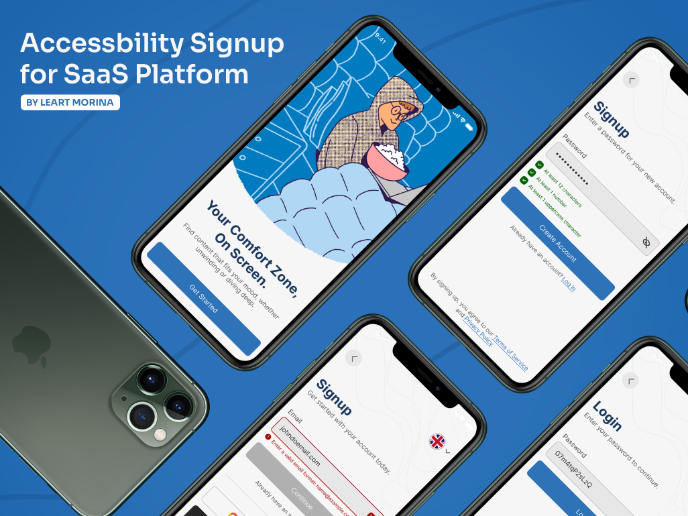

Accessible Signup & Login Experience — Brainex

Accessible Signup Form

Accessible Signup Form

WellNest

Design Leadership Courses

UX Design Foundations

Introduction to Figma