Customer Journey Map for BNPL Feature

Persona

Persona Name: Alex Rivera

Job Title: Marketing Coordinator (Age: 28, Tech-savvy millennial with variable income, frequent online shopper seeking flexible payment options to manage budget without credit card debt.)

Scenario

Purchasing a $200 gadget (e.g., wireless earbuds) through the fintech app using the Buy Now Pay Later (BNPL) feature, splitting into 4 interest-free installments. This journey covers from discovering the option at checkout to completing repayments, highlighting pain points and opportunities for improvement.

Measures of Success/Achievements:

- Successful completion of purchase with BNPL approval in under 2 minutes.

- On-time repayments leading to increased credit limit for future uses.

- User satisfaction score >8/10 via post-purchase survey.

- Reduction in cart abandonment by 25% app-wide.

- Low default rate (<2%) through effective reminders and education.

Journey Steps

The journey is divided into 4 key steps:

- Step 1: Discovery & Consideration (User becomes aware of BNPL at checkout and evaluates it.)

- Step 2: Application & Approval (User applies for BNPL and gets instant decision.)

- Step 3: Purchase & Confirmation (User completes the transaction using BNPL.)

- Step 4: Repayment & Follow-Up (User manages and completes installments post-purchase.)

Tools used

From brief

Topics

Share

Reviews

5 reviews

Really solid vibe here—the journey is broken down clearly (discovery to repayments), and Alex’s persona gives it a real human touch. That “under 2-minute approval” goal and metrics like lowering cart abandonment really make the impact feel concrete.

To make it pop even more:

- Visualize the steps—a simple journey flow or light diagram could help viewers follow the user’s path at a glance.

- Call out the pain points—highlighting where users hit friction (checkout hesitation, repayment anxiety) makes the insights jump off the page.

- Add context with a story line—a short line like “Alex discovers BNPL at checkout, applies, gets approved fast, then manages easy payments” would turn it into an even more relatable moment.

Overall, you’ve built a thoughtful map that balances empathy with strategy—just a bit more visual storytelling and framing will make it shine.

Hi Shayan, this journey map clearly shows the BNPL experience with a realistic persona and concrete success measures tied to business outcomes. The four-step journey effectively highlights pain points and opportunities throughout the user experience. Great work!

It helpful to me! Great job!

This journey map presents a thoughtful visualization of Alex Rivera’s interaction with the BNPL feature. The structure is clear, moving from discovery to repayment, and the persona adds a realistic context that makes the scenario relatable. The inclusion of measurable success criteria (like approval time and cart abandonment rates) strengthens the map’s connection to business outcomes.

Strengths

- Persona Depth – Alex’s persona is well thought out, covering demographics, behavior, and motivations, which makes the journey credible and human-centered.

- Step-by-Step Flow – Breaking the journey into four distinct stages ensures clarity and makes it easy for readers to follow the user’s path.

- Business Alignment – The integration of KPIs such as repayment rates and credit limit growth ties the design work back to tangible business value.

- User Perspective – The addition of thoughts and emotions helps to surface friction points and makes the experience easier to empathize with.

Adding light visual storytelling, such as icons or a simple flow diagram, would make the journey even more engaging.

Joshua T Kim

nice

You might also like

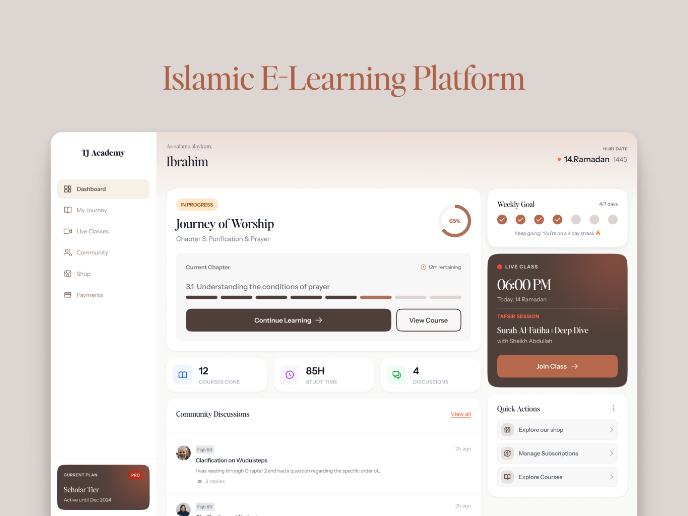

Islamic E-Learning Platfrom Dashboard

Pulse — Music Streaming App with Accessible Light & Dark Mode

SiteScope - Progress Tracking App

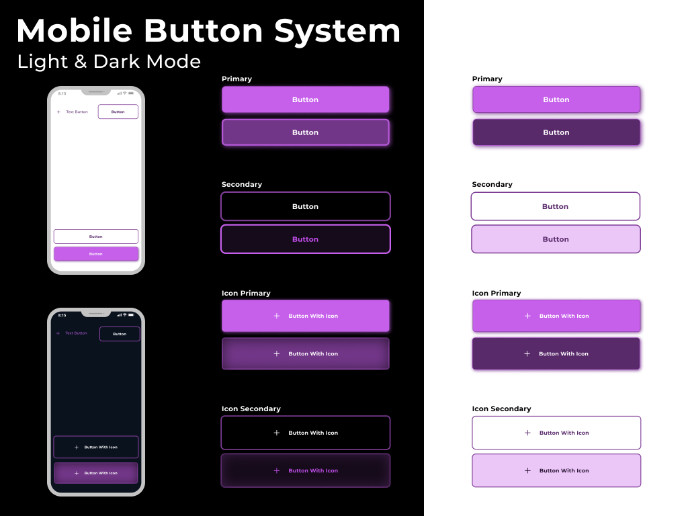

Mobile Button System

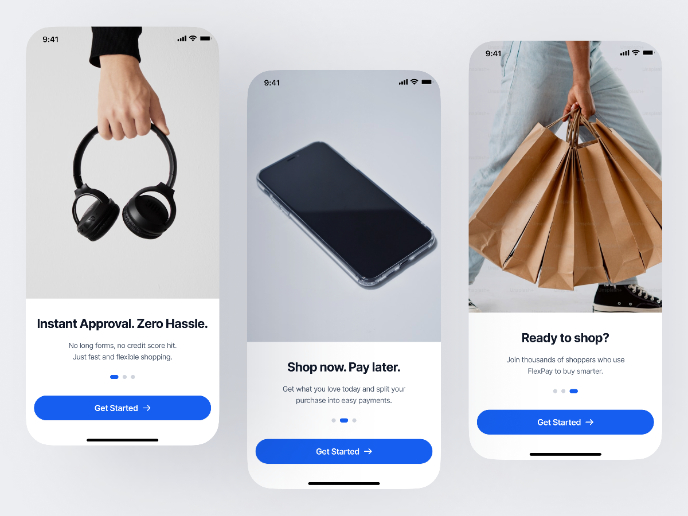

FlexPay

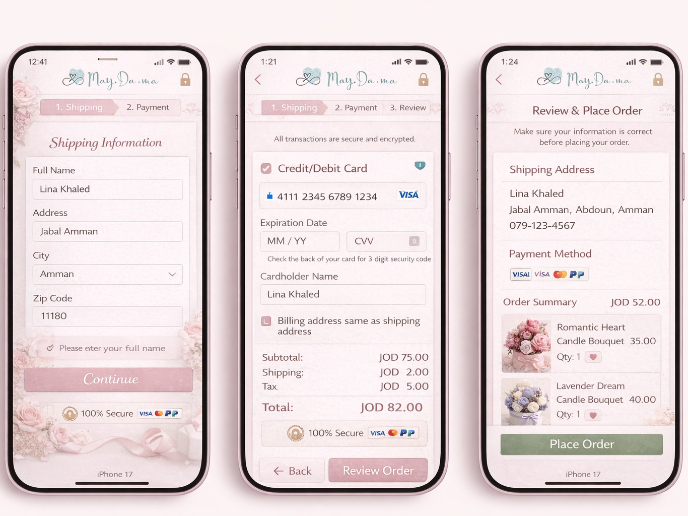

May.Da.Ma Candles & more

User Research Courses

Ethical & Responsible Product Design

The Product Development Lifecycle & Methodologies