Savings app

Project Overview

For my project of creating an empathy map, I revisited an older school project and framed it into the empathy map format.

Background: Traditional banks in Norway have not yet fully utilized the potential of "open banking" and the PSD2 directive. SBN (a fictitious bank) aims to leverage these opportunities to attract new customers and offer a new personal finance service. "Open banking" and PSD2 allow third-party providers to offer innovative apps and services to consumers, and SBN wants to capitalize on this.

Target Group: Students aged 18-30 in urban areas, aiming to improve their financial independence and security.

Device: Mobile

Method:

1. Exploratory Interviews and Empathy Mapping:

- Conducted 4 user interviews to gather insights (key findings and understandings).

- The empathy map is based on these interviews.

2. Desk Research and Competitive Analysis:

- Reviewed available financial management apps that focus on similar user needs found in exploratory interviews:

- Need 1: Financial overview

- Need 2: Motivation

3. Ideation, Prototyping, and Testing:

- Sketched solutions addressing identified pain points.

- Conducted usability tests with the prototype to identify improvement areas.

4. Validation:

- Distributed surveys among students and collected 35 responses to test concept, value proposition and willingness to use and pay for such a application.

5. Feedback Integration:

- Enhanced the prototype and business model.

- Presented to stakeholders to obtain GO/NO-GO feedback for further development.

Insights from interview:

Students find it challenging to manage their finances due to a lack of clear, simple tools.

Existing financial apps offer rewards that are not relevant to the Norwegian market, reducing their motivation.

Students are unwilling to pay for financial management apps, expecting them to be free.

Students seek a straightforward way to oversee their spending and budgeting, akin to what Spiir (mentioned application) offers.

Insights from usertesting:

Gamification: Students react positively to app and to motivation through gamification.

Suggestion: Improve gamification elements to make saving and budgeting more engaging, inspired by Hold and Rutte.

Insights from survey:

Sustainability and Business Model: There was interest in the app during the survey, but no willingness to pay.

Suggestion: Explore alternative revenue streams, such as collaborating with businesses to promote their services through the app and gaining access to the user group. Ensure the app is free to use, considering that most students don't pay for applications they use. Some mentioned that they pay up to $50 annually for specific apps like training apps.

Insights from desk research:

Relevant Rewards: Feedback indicates that rewards in existing apps were not relevant to the Norwegian market.

Suggestion: Establish partnerships with local businesses and services to offer attractive and relevant rewards for students, similar to the approach of Hold and Rutte.

Reviews

2 reviews

Hi Øyvind, this project shows thorough research methodology. You've combined interviews, competitive analysis, and surveys to understand the student market, and your empathy mapping effectively surfaces real pain points around financial stress and control.

The research is well-executed and your findings are clearly articulated!

Your research is very thorough and considerate. The analysis and insights are thoughtful and provide a strong foundation for future improvements to the app. Well done!

You might also like

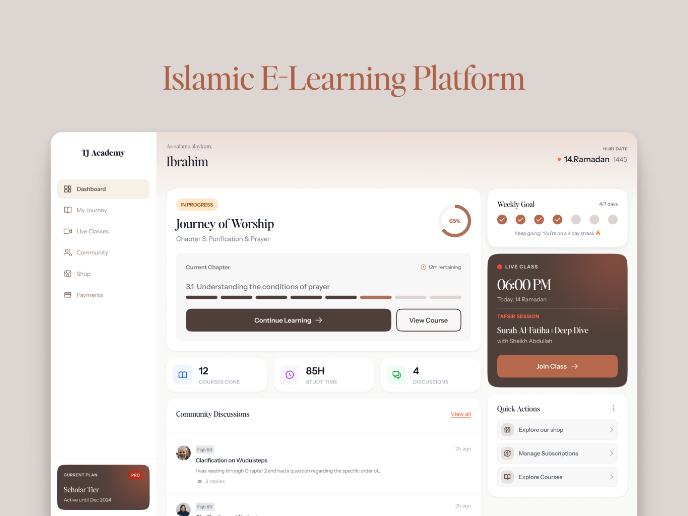

Islamic E-Learning Platfrom Dashboard

Pulse — Music Streaming App with Accessible Light & Dark Mode

SiteScope - Progress Tracking App

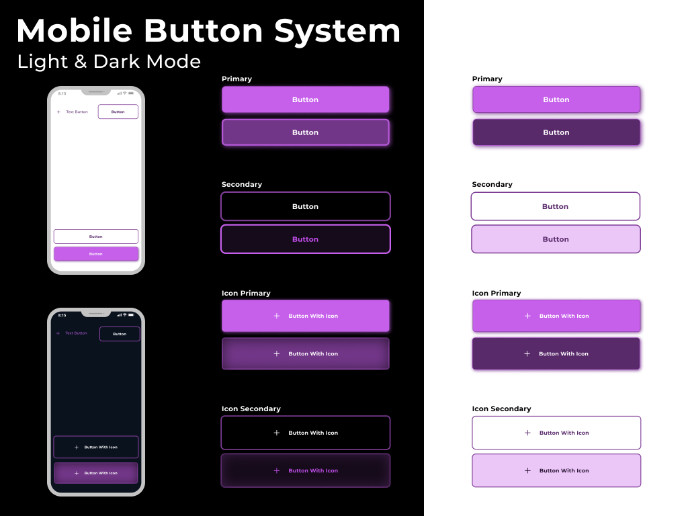

Mobile Button System

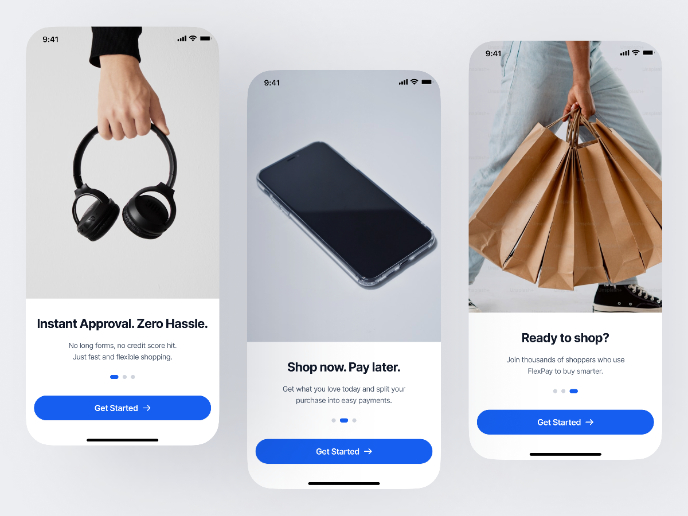

FlexPay

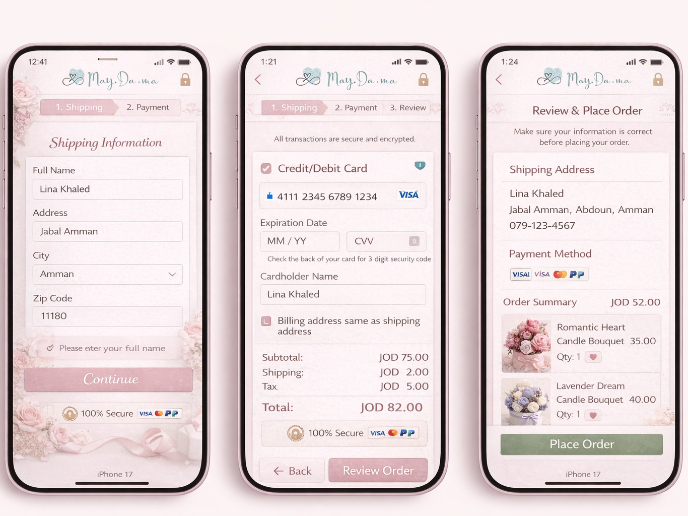

May.Da.Ma Candles & more

Design Leadership Courses

UX Design Foundations

Introduction to Figma