RICE Template for Fintech BNPL Feature Prioritization

Implement prioritization with clear features, reach, impact, confidence, and effort. Track results to evaluate product ideas objectively. Helps allocate resources effectively. This plan defines and prioritizes features for the Buy Now Pay Later (BNPL) feature within our fintech app to enhance user experience (e.g., reducing repayment anxiety, increasing trust) and drive adoption/conversions (e.g., increasing transaction volume by 25% and reducing churn by 10%).

Tools used

From brief

Topics

Share

Reviews

4 reviews

This RICE template feels solid and practical. It's organized and shows real clarity by laying out Reach, Impact, Confidence, and Effort to help pick the right features for BNPL. The goals like “reduce repayment anxiety” and “push transactions +25%” make it feel grounded in real business wins, not just theory.

To make it even stronger:

- Sprinkle in visuals which is a simple matrix or chart could help people instantly grasp how you're ranking ideas.

- Give a quick example to show how one feature scored against the others to make the process feel tangible.

- Share your “why” a line like “Used this to debate which feature to build in Q3” helps add context and personality to the prioritization.

Overall, you’ve got a smart and structured plan here and just a bit of visual storytelling and context could make it feel even more relatable and compelling.

This RICE prioritization project is clear, practical, and super easy to follow. The breakdown of each feature using Reach, Impact, Confidence, and Effort makes the decision process transparent and grounded in real goals, like reducing repayment anxiety and boosting transactions. I like how you’ve tied the framework to real business outcomes—this keeps things focused and relevant.

One thing that could make it even better: add a simple visual, like a chart or matrix, to help people quickly see how features stack up. Also, a quick example calculation or a short “why we picked this feature” blurb would make the process feel even more real and relatable.

Keep up the great work—this is a solid foundation, and a few tweaks could make it even more engaging!

This RICE template is a good way to prioritize features for a BNPL product. It explains reach, impact, confidence, and effort clearly, which makes the decision process more simple and structured. Connecting the framework to goals like increasing transactions by 25 percent and reducing churn by 10 percent shows clear focus on results.

It is also great that you focused on reducing repayment anxiety and building trust, since these are important for users in fintech. To make it even better, you could add examples of how different features were scored in the RICE framework. This would show how you made choices in real situations.

You could also add a feedback step, so after launching features you can check results and use them to improve future scoring.

Overall, this is a useful and practical template that can help in planning BNPL features and managing resources effectively.

Overview

This document applies the RICE prioritization framework to potential BNPL feature enhancements within the fintech app. Each idea is evaluated against reach, impact, confidence, and effort, producing a clear score that allows the team to allocate resources effectively. The prioritization aligns well with business goals such as reducing repayment anxiety, building trust, and driving adoption through higher transaction volume and lower churn.

Strengths

- Structured Framework – Using RICE provides an objective and systematic approach to feature prioritization.

- Relevant Feature Set – The selected ideas (e.g., repayment rewards, personalized plans, automated reminders) directly address user pain points identified earlier.

- Quantitative Scoring – Concrete numbers for reach, impact, and effort help compare initiatives transparently.

- Business Alignment – The prioritization clearly ties to retention and conversion goals, making it practical for roadmap planning.

A simple visual chart of scores could make prioritization outcomes even more intuitive for stakeholders.

You might also like

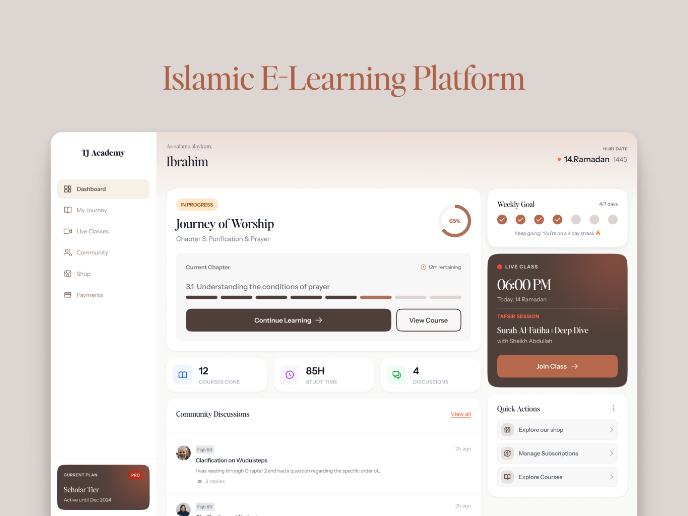

Islamic E-Learning Platfrom Dashboard

Pulse — Music Streaming App with Accessible Light & Dark Mode

SiteScope - Progress Tracking App

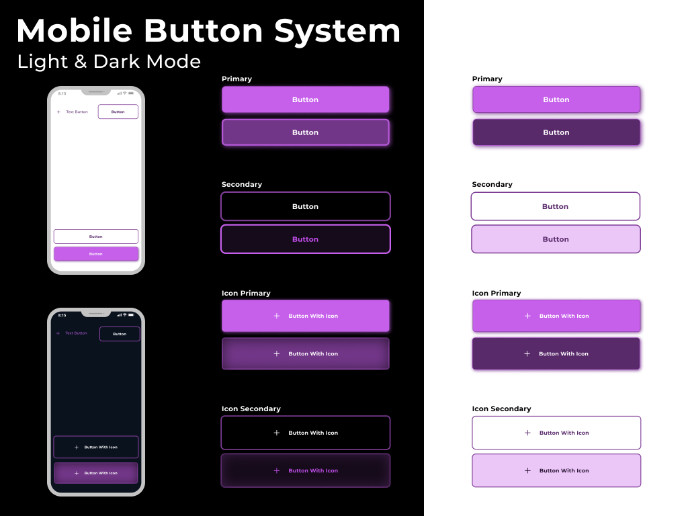

Mobile Button System

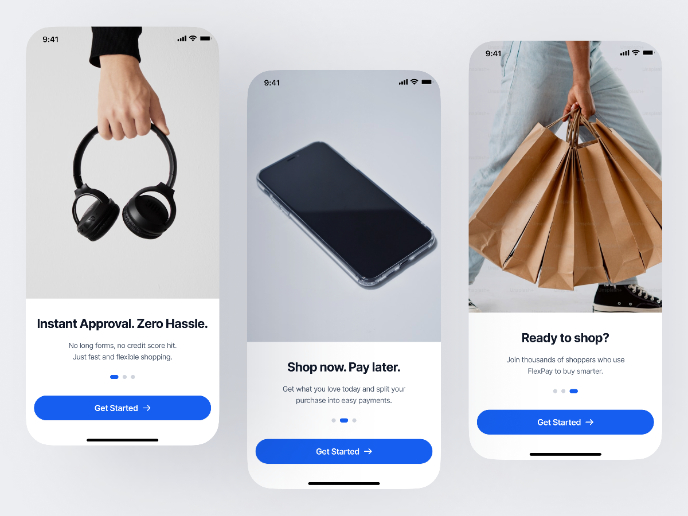

FlexPay

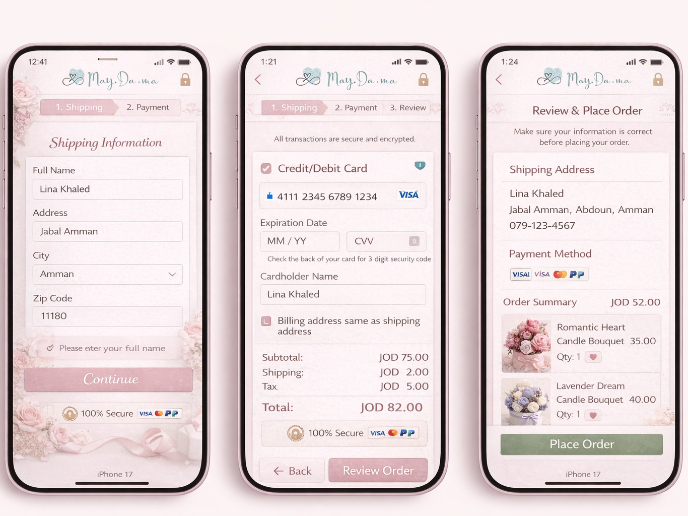

May.Da.Ma Candles & more

Product Development Courses

Introduction to Figma

UX Writing