Product Retention Strategy for BNPL Feature

⚠️ Problem Analysis

Daily Active Users (DAU): 100,000 users/day (BNPL-specific: ~20,000 engagements/day post-launch).

Churn Rate: 35% monthly churn (users drop off after first use due to repayment concerns).

Key User Feedback Points:

- Difficult to track installments and understand late fees.

- Approval process feels opaque, leading to distrust in credit scoring.

- Lack of personalized reminders causes missed payments and frustration.

- Limited integration with shopping habits reduces repeat usage.

- Overwhelming notifications perceived as spammy.

Major Drop-off Points:

- After initial approval but before confirming first purchase (e.g., hesitation on terms).

- During repayment phase, especially after first installment (forgetfulness or budget shifts).

- Post-purchase if no value-add like rewards or upsell prompts.

- At onboarding when users don't see immediate BNPL benefits.

- If app crashes or slows during high-traffic checkout.

Tools used

From brief

Topics

Share

Reviews

2 reviews

Product Retention Strategy for the BNPL Feature feels smart and user-first—it’s clear you’re thinking about how to keep people coming back, not just onboarding them once (which is key for BNPL). Calling out metrics like engagement and churn helps ground your strategy in real impact, not just theory.

To make it even more engaging:

- Bring it to life visually—maybe use a simple chart or flow to show how your retention steps feed into better user habits or fewer drop-offs.

- Walk us through one key win—for instance, “We sent personalized reminders and saw overdue rates drop by 15%.” A quick before/after anecdote makes it feel real.

- Share the “why behind the why”—a line like “Figured out people bail when they don’t understand payment timelines” adds real personality and connection.

Overall, you’ve built a solid, insight-driven strategy. A touch more storytelling and visuals could turn it from solid logic into something really memorable.

Overview

This document outlines a retention-focused analysis for the BNPL feature within the FinFlex app. It provides a structured overview of daily activity, churn rate, user feedback, and major drop-off points. The data is presented clearly and emphasizes the key challenges that affect ongoing engagement and user trust, making it a useful foundation for building targeted retention strategies.

Strengths

- Clear Metrics – Daily active users and churn rate are presented with specific numbers, grounding the analysis in measurable reality.

- Detailed User Feedback – Pain points such as installment tracking, opaque approvals, and spammy notifications are well captured.

- Drop-off Mapping – The analysis identifies critical drop-off moments across onboarding, purchase, and repayment phases.

- Focus on Retention Risks – The emphasis on churn and missed repayments directly connects to the retention challenge the feature faces.

Addressing pain points with personalized reminders, clearer approval flows, and added post-purchase value would make the strategy more actionable.

You might also like

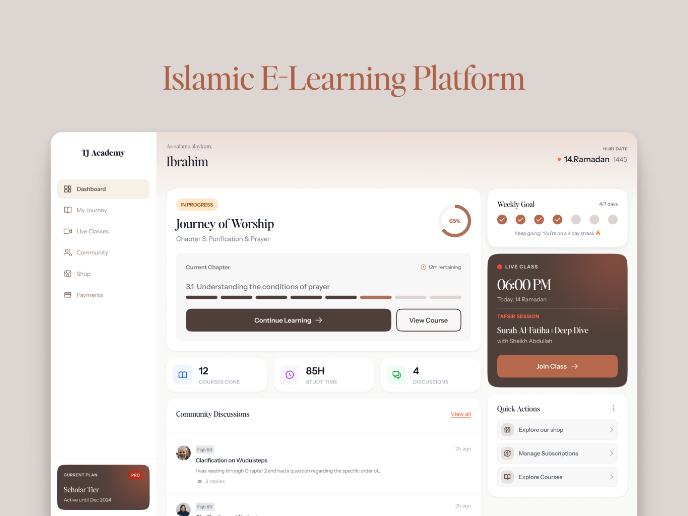

Islamic E-Learning Platfrom Dashboard

Pulse — Music Streaming App with Accessible Light & Dark Mode

SiteScope - Progress Tracking App

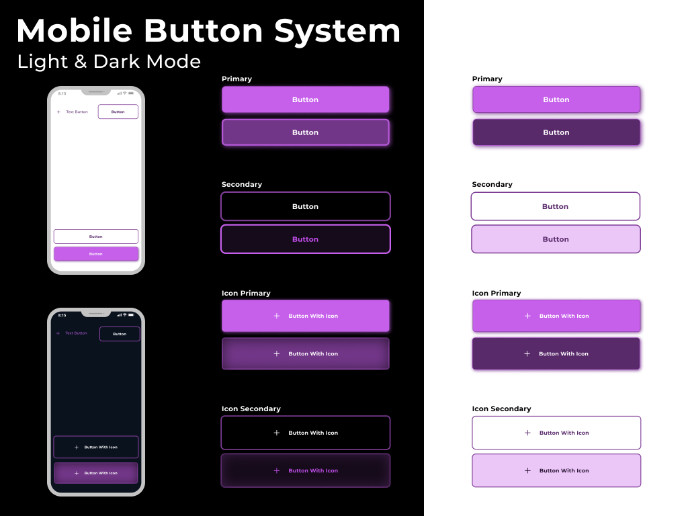

Mobile Button System

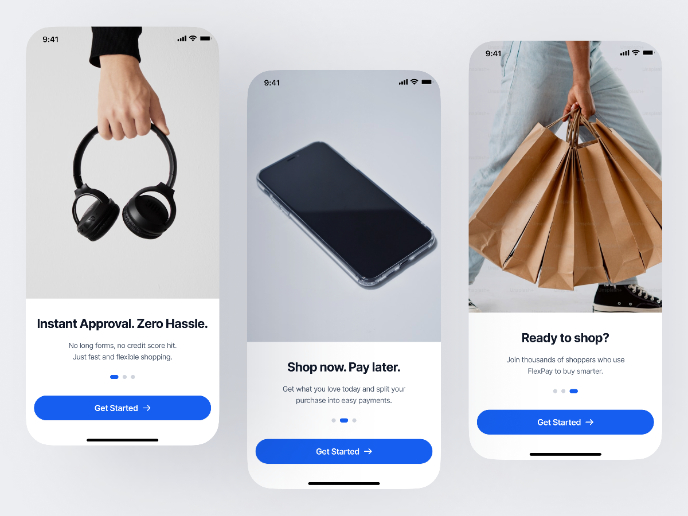

FlexPay

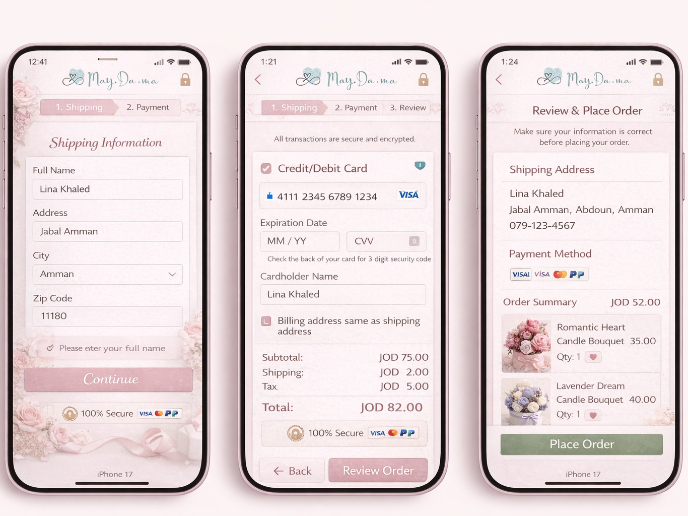

May.Da.Ma Candles & more

Product Thinking Courses

Ethical & Responsible Product Design

Product Vision & Strategy